Federal Unemployment Extension Filing

|

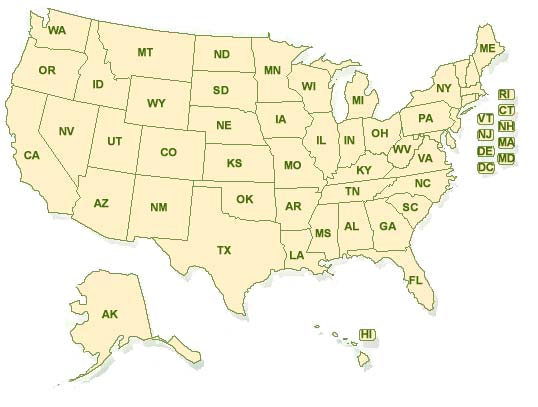

State Claims Map (Choose) |

Start the Federal Unemployment Extension process by completing the form above. For additional information regarding extensions or benefits options in any state, simply select the state you are currently unemployed in above. Initial filings can be completed online as well.